Fund Momentum - Fresh Funds Ready to Deploy #16

Welcome to the sixteenth edition of my bi-weekly newsletter, where I bring you the latest on newly raised funds (VC & PE) that are ready to deploy capital.

Michael Schneider is a serial founder, operator, VC scout and startup advisor. As a seasoned entrepreneur, he launched his own fundraising consultancy, "Seedraisr.” Through his expertise and network, he primarily supports early-stage startup founders during their funding rounds, and emerging VC fund managers. He closely follows developments in the venture capital market and provides these insights in his biweekly newsletter.

Today’s edition features the newest funds raised, in late May & early June 2025, including a total of 26 VC & PE funds.

Here’s what you’ll find about each fund:

Fund Name

Fund Size

Location

Industry Focus

Investment Stage

Website

Fund Managers with LinkedIn Profiles

So, without further ado, here are the first 10 of the freshest funds primed for investment (in no particular order) + you can from now on also listen to them on Spotify & Apple Podcasts:

Cathay Innovation Fund III | €1B | France | AI, Health, Fintech, Mobility, Energy | Early & Growth Stage| cathayinnovation.com | Denis Barrier (Co-Founder & CEO). Jacky Abitbol (Managing Partner, EU), Daniel BALMISSE (Managing Partner, FoF, EU)

Picus Venture Fund II | €250M | Germany | Generative AI, Cybersecurity, Climate Tech, Enterprise Software, Fintech, SaaS | Pre-Seed to Growth | picuscap.com | Alexander Samwer (Founding Partner), Florian Reichert, Robin Godenrath (Partner & Managing Director)

Energize Capital Ventures Fund III | $430M | USA | Climate Solutions, Industrial Digitization, Energy Transition | Early-stage | energizecap.com | John Tough (Managing Partner), Katie McClain (Partner & COO)

Merlin Ventures Fund I | $75M+ | Israel | Cybersecurity | Early-stage | merlin.vc | Shay Michel (Managing Director), Seth Spergel (Managing Partner)

Planeteer Capital Fund I | $54M | USA | Climate Tech | Early-stage | planeteercapital.com | Sophie Purdom (Managing Partner)

Zeal Capital Partners Fund II | $82M | USA | Fintech, Healthcare, Future of Learning & Work | Early-stage | zealvc.co | Nasir Qadree (Founder & Managing Partner), Richard Odior (Head of pre-seed/seed investments)

Metalayer Fund I | $25M | USA | Blockchain, Financial Services, Stablecoins, Tokenization | Early-stage | metalayer.vc | Andy Kangpan, David Winton, Mickey Graham (Co-Founder & GP)

Nordic Foodtech VC Fund II | €40M (first close, target €80M) | Finland | FoodTech, Agriculture | Pre-Seed, Seed | nft.vc | Louise Heiberg, Lauri Reuter (Partner)

Masia Fund | €20M | Spain | GenAI, Healthtech, Biotech, Fintech, Blockchain, Climate, Defense, Hardware | Pre-Seed & Seed | masia.vc | Carlos Trenchs (Co-Founder & Chairman), Pepe Borrell (Co-founder & Partner)

Iron Wolf Capital Fund II | €30M (first close, target €100M) | Lithuania | Deep-tech, AI, Biotech, Spacetech, Energy | Early-stage (Seed) | ironwolfcapital.com | Zygimantas Susnys (Founding Partner), Kasparas Jurgelionis (Managing Partner)

Offerings:

Raising funding? You might not need as much. Arcanys Ventures trades $200–400k in senior dev power for equity (or hybrid 50/50) so you can launch faster and raise leaner. Interested to learn more → hit me up!

Raising for your early-stage startup? Get tailored fundraising support, incl. pitch deck review, storytelling, deal terms & intros to smart money (VCs, FOs, HNWIs). → [Apply here]

Looking for high-quality, pre-vetted deal flow? Get access to exclusive startup opportunities + hands-on portfolio support (product, sales, fundraising).

→ [Get in touch]

Content Corner:

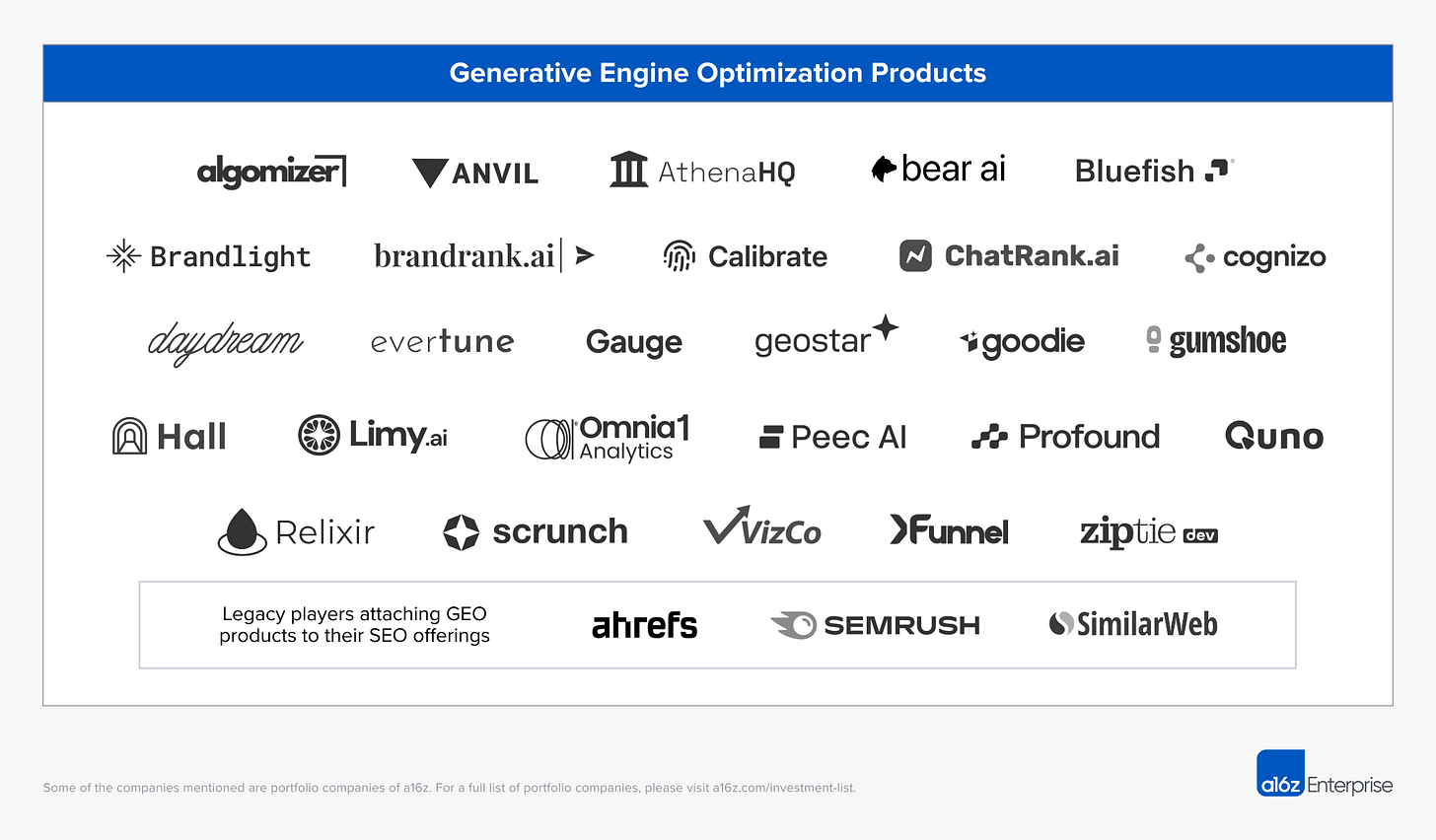

Goodbye SEO. Hello GEO. LLMs have changed how discovery works -

[LI Posting] - [a16z article by Seema Amble & Zach Cohen]Europe’s Multi-Trillion Innovation Opportunity - [LI Posting]

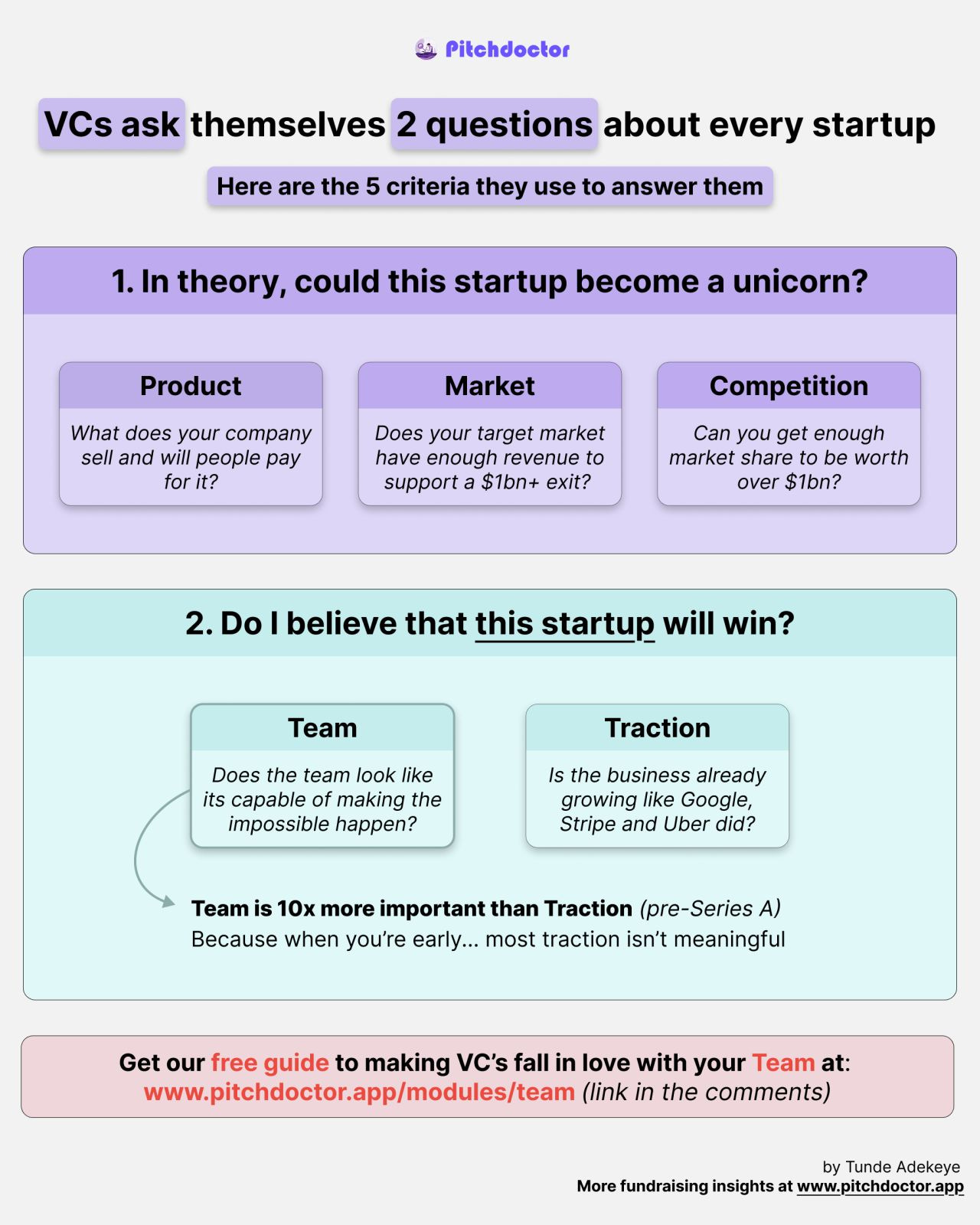

VCs asking themselves 2 fundamental questions about your startup: - [LI Posting by Tunde Adekeye]

“Start your VC fund in under 24 hrs—with no setup fees and $10 K LP checks.” - [VC Labs article]

“These under-the-radar initiatives are the unsung architects of Europe’s tech renaissance.” - [Operator & Friends by Alex Krass, Juhana Peltomaa, Michelangelo Pagliara]

Stealth Momentum: New Funds in the Making or Under the Radar - presented by Specter:

Pepe Borrell - Comes Out of Stealth and announces a New Fund: Masia as "Co-Founder & Partner" - Specter Score 8/10

Sumeet Singh - Comes Out of Stealth and announces a New Fund: Worldbuild as "Founder & Managing Partner" - Specter Score 7/10

Sakshi Sharma - Comes Out of Stealth and announces a New Fund: Hypa Foundry as "CEO & Co-Founder" - Specter Score 7/10

Don’t miss the full breakdown: unlock 16 more fresh funds in this edition and access 524 total since September 2024. Subscribe monthly for complete articles, or become a founding member (one-time payment) to get access to the complete fund list spreadsheet delivered directly to your inbox.